Insurance plays a crucial role in safeguarding our future and providing peace of mind in times of uncertainty. Whether it’s protecting your home, vehicle, health, or business, having the right insurance coverage in place is essential. Ferguson & McGuire stands out as a trusted independent insurance agency with a rich history of serving clients in Connecticut since 1938. With their comprehensive range of personalized insurance solutions, they have helped countless individuals and businesses secure the protection they need.

From auto and homeowners insurance to life and commercial insurance policies, Ferguson & McGuire takes pride in offering tailored coverage options to meet the unique needs of each client. Their team of experienced insurance professionals works closely with customers to assess risks, identify gaps in coverage, and provide expert guidance on selecting the most suitable insurance products. With a commitment to excellence and a dedication to customer satisfaction, Ferguson & McGuire has earned a reputation for reliability and integrity in the insurance industry.

Types of Insurance Policies

There are various types of insurance policies available to cater to different needs and protect individuals from unforeseen circumstances. Some common types of insurance include life insurance, health insurance, and property insurance.

Life insurance provides financial support to the policyholder’s beneficiaries in the event of the policyholder’s death. This ensures that loved ones are taken care of financially, even when the policyholder is no longer present.

Health insurance offers coverage for medical expenses, including doctor’s visits, surgeries, and prescription medications. It helps individuals access quality healthcare without worrying about the financial burden of medical treatments.

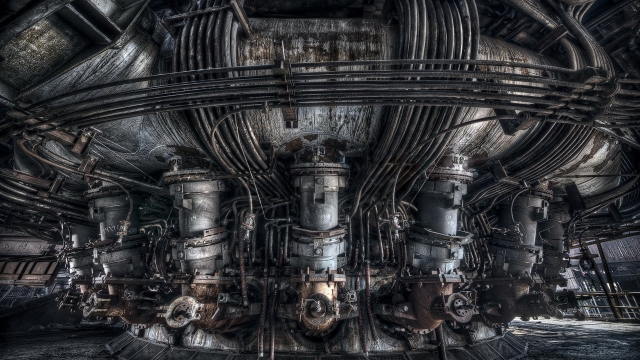

Connecticut ATV Insurance

Property insurance protects assets such as homes, vehicles, and businesses against damage, theft, or other risks. It provides peace of mind knowing that your valuable possessions are safeguarded in case of any unforeseen events.

Benefits of Choosing Ferguson & McGuire

When it comes to safeguarding your future through insurance coverage, Ferguson & McGuire stands out as a trusted partner with a rich history dating back to 1938. With decades of experience, they have honed their expertise in providing personalized insurance solutions tailored to meet the unique needs of each client.

One of the key advantages of choosing Ferguson & McGuire is their status as an independent insurance agency. This independence allows them to work with a diverse range of insurance providers, giving clients access to a wide array of options to find the right coverage at the best value. This flexibility ensures that clients can select policies that align perfectly with their specific requirements.

Furthermore, Ferguson & McGuire’s commitment to exceptional customer service sets them apart in the industry. Their team of professionals goes above and beyond to offer personalized assistance, guidance, and support throughout the insurance selection and claims process. Clients can have peace of mind knowing that they have a dedicated partner who is always ready to help navigate the complexities of insurance coverage.

Tips for Selecting the Right Insurance Coverage

When choosing insurance coverage, one important aspect to consider is the reputation and experience of the insurance agency. Ferguson & McGuire has been a trusted name in the insurance industry since 1938, providing tailored insurance solutions to clients in Connecticut. Their long-standing presence and commitment to personalized service make them a solid choice for your insurance needs.

Another key tip is to assess your specific insurance requirements before selecting a policy. Whether you need coverage for your home, auto, business, or personal assets, Ferguson & McGuire offers a wide range of insurance options to meet your unique needs. By understanding exactly what you need to protect, you can make a more informed decision when choosing the right insurance coverage for your future.

Lastly, don’t forget to review the coverage limits, deductibles, and exclusions of each policy before making your final decision. Ferguson & McGuire’s independent status allows them to offer a variety of insurance options from different providers, giving you the flexibility to compare and choose the coverage that best suits your individual situation. By carefully examining the details of each policy, you can ensure that you are getting the right insurance coverage to safeguard your future.