Welcome to the world of financial security with securitization solutions! In our exploration of this powerful financial tool, we will delve into the realms of Switzerland and Guernsey, uncover the benefits of securitization, and highlight the expertise of Gessler Capital, a Swiss-based financial firm at the forefront of securitization and fund solutions.

https://www.gesslercapital.com/blog

Securitization solutions have become increasingly popular in today’s financial landscape, offering a means to unlock and optimize the value of various assets. In Switzerland, a renowned hub for financial services, securitization solutions have gained significant traction, providing businesses and investors alike with greater flexibility and efficiency. With a strong regulatory framework and investor-friendly environment, Switzerland has paved the way for innovation in securitization.

Meanwhile, Guernsey has emerged as a leading player in structured products, offering a secure and sophisticated platform for securitization transactions. Known for its robust legal and regulatory framework, Guernsey provides a stable and transparent environment, attracting numerous businesses seeking to enhance their financial strategies through structured products.

As financial networks continue to expand globally, securitization solutions have proven to be a pivotal catalyst. By transforming illiquid assets into tradable securities, these solutions enable institutions to diversify their portfolios, mitigate risk, and enhance liquidity. Such financial network expansion has paved the way for greater market access and increased opportunities for investors from around the world.

Among the pioneers in securitization and fund solutions, Gessler Capital stands out as a beacon of expertise and innovation. Based in Switzerland, Gessler Capital offers a comprehensive suite of securitization solutions tailored to fit the unique needs of businesses and investors. With a wealth of experience and a commitment to excellence, Gessler Capital has successfully navigated the complexities of securitization, providing its clients with the confidence and tools to achieve their financial goals.

Join us as we embark on an enlightening journey through the world of securitization solutions, discovering the immense potential they hold for unlocking financial security and propelling businesses and investors towards a more prosperous future.

Exploring Securitization Solutions

Securitization Solutions, a powerful tool in the world of finance, have gained considerable attention in recent years. With a focus on Switzerland, a leading hub for financial services, and the offerings of Guernsey Structured Products, the potential for financial network expansion is immense. One notable player in this field is Gessler Capital, a Swiss-based financial firm known for its wide range of securitization and fund solutions.

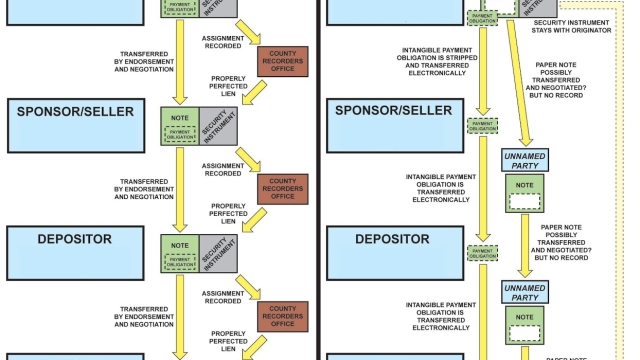

Securitization Solutions in Switzerland offer a unique investment opportunity for both individuals and institutional investors. By pooling together various financial assets such as mortgages, loans, and credit card receivables, these solutions allow for the creation of asset-backed securities. These securities are then sold to investors, providing them with a diversified portfolio and a stable income stream.

The benefits of securitization don’t stop there. Through Guernsey Structured Products, investors can access innovative investment strategies that offer enhanced risk management and potential for higher returns. These products are structured through complex financial engineering techniques, leveraging the expertise of Gessler Capital and other financial institutions. With the growth and sophistication of financial markets, the demand for these specialized products has only increased.

Gessler Capital, with its reputation as a trusted financial firm, plays a crucial role in offering securitization and fund solutions to clients. Their expertise and experience enable them to develop tailored investment structures that align with clients’ unique financial goals and risk appetite. By combining securitization with their extensive network and market knowledge, Gessler Capital opens up a world of possibilities for investors looking to achieve financial security and growth.

By exploring the power of securitization solutions, investors can unlock new avenues for financial success. The combination of Switzerland’s strong financial infrastructure, the innovation of Guernsey Structured Products, and the expertise of firms like Gessler Capital creates a compelling proposition for those seeking to maximize their investments. Whether it’s diversification, risk management, or higher returns, securitization solutions offer a comprehensive toolkit for individuals and institutions aiming to secure their financial future.

Benefits of Guernsey Structured Products

Guernsey structured products offer a range of benefits for investors looking to enhance their financial security.

Firstly, these products provide investors with an opportunity to diversify their portfolio. By investing in Guernsey structured products, individuals can access a wide range of asset classes and sectors. This diversification helps spread risk and potentially increase returns, as investors are not reliant on a single investment or industry.

Secondly, Guernsey structured products provide flexibility in terms of investment strategies. These products can be custom-tailored to meet specific investment goals and risk appetites. Whether an investor is seeking capital preservation, income generation, or capital growth, Guernsey structured products can be designed to align with their objectives.

Additionally, Guernsey structured products offer enhanced transparency and regulatory protection. The Guernsey Financial Services Commission ensures that these products adhere to stringent regulations and provides a robust framework for investor protection. This transparency helps build trust and confidence among investors, enabling them to make informed investment decisions.

Overall, Guernsey structured products present a compelling option for investors seeking to unlock financial security. With their diversification benefits, flexible investment strategies, and strong regulatory oversight, these products can play a pivotal role in achieving investment goals and expanding one’s financial network.

Financial Network Expansion Opportunities

With the growing demand for securitization solutions, there are ample opportunities for financial network expansion. A robust network enables financial firms to enhance their market reach and offer tailored securitization solutions to a wider client base.

Expanding the financial network not only opens doors for accessing new markets but also facilitates collaboration with industry experts and potential partners. This collaboration allows for the sharing of knowledge and expertise, ultimately leading to the development of innovative securitization solutions.

Switzerland, known for its strong financial sector, provides an ideal hub for expanding the financial network in the realm of securitization solutions. Swiss-based financial firms, such as Gessler Capital, have a solid foundation to leverage their expertise and access a diverse pool of investors.

Furthermore, exploring opportunities beyond Switzerland, Guernsey structured products present an appealing avenue for financial network expansion. The expertise and credibility associated with Guernsey’s structured products industry can enhance a firm’s reputation and attract potential investors from around the world.

To unlock these financial network expansion opportunities, financial firms need to emphasize building strong relationships, staying informed about market trends, and actively participating in industry events and conferences. This proactive approach can foster valuable connections, leading to the growth of a robust financial network.

In conclusion, the world of securitization solutions offers exciting prospects for financial network expansion. By tapping into markets like Switzerland and exploring avenues like Guernsey structured products, firms like Gessler Capital can expand their reach and offer tailored securitization solutions to a broader client base. Building a strong financial network through collaboration and strategic partnerships will be key to unlocking the full potential of these opportunities.