Business Tax Law can be a daunting and complex subject for many business owners and entrepreneurs. With ever-changing regulations and intricate guidelines, understanding and navigating through the intricacies of business tax law can seem like unlocking a well-guarded vault of secrets. However, by breaking down the complexities and demystifying the daunting aspects, we can provide a clear, concise, and comprehensive guide to help businesses effectively manage their tax obligations while maximizing their financial endeavors.

In this business finance guide, we will delve into the depths of business tax law, shedding light on its intricacies and unraveling the key concepts and principles that underpin it. From understanding the different types of business taxes to exploring the various deductions and credits available, we will equip you with the knowledge necessary to ensure compliance and optimize your financial strategies.

Throughout this guide, we will address common questions and concerns faced by business owners, providing practical tips and strategies for mitigating tax liabilities, avoiding penalties, and making informed decisions that align with your overall business goals. By unraveling the complexities of business tax law, we aim to empower you with the knowledge and confidence needed to navigate this landscape with precision and poise.

Join us on this journey as we demystify the complexities, debunk the myths, and unlock the secrets of business tax law, arming you with the tools and insights to thrive in an ever-evolving financial landscape. Let’s dive in and uncover the hidden treasures of business tax law together.

Understanding Business Tax Obligations

Business tax obligations are a crucial aspect of running a successful company. Understanding and complying with these obligations is essential to prevent legal complications and ensure smooth operations. In this section, we will delve into the various business tax obligations that every entrepreneur should be aware of.

Income Tax: Business owners are required to report and pay income taxes based on the profits generated by their companies. These taxes are usually paid annually and are calculated by applying the applicable tax rate to the net income of the business. It is important for business owners to maintain accurate financial records and seek professional guidance when calculating their income tax obligations.

Employment Taxes: If your business has employees, you have certain tax responsibilities related to their wages or salaries. These employment taxes include federal income tax withholding, Social Security and Medicare taxes, and federal unemployment tax. Business owners must ensure that these taxes are properly withheld from employee paychecks and deposited with the appropriate tax agencies.

Sales Tax: Depending on the nature of your business and the location where you operate, you may be required to collect and remit sales tax. Sales tax is a consumption-based tax levied on the sale of goods or services to the end consumer. It is crucial to understand the sales tax regulations in your jurisdiction and comply with the reporting and payment requirements.

By understanding these business tax obligations, entrepreneurs can ensure that they meet their legal responsibilities and avoid potential penalties or legal issues. It is recommended to consult with a tax professional or accountant to ensure accurate compliance with all applicable tax laws and regulations.

Navigating Tax Deductions and Credits

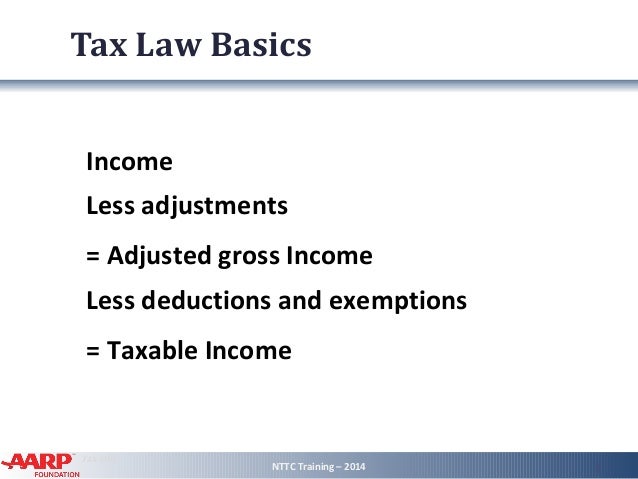

In the world of Business Tax Law, understanding the intricacies of tax deductions and credits is key to optimizing your tax strategy. By taking advantage of these benefits, businesses can potentially reduce their taxable income and ultimately minimize their tax liability. In this section, we will demystify the complexities surrounding tax deductions and credits, providing you with valuable insights to navigate this aspect of business taxation.

One common avenue for businesses to explore is tax deductions. These are expenses that can be subtracted from the total income, thus lowering the taxable income amount. Deductions can include a wide range of business-related expenses, such as office rent, employee salaries, advertising costs, and utility bills. By carefully documenting and claiming these deductible expenses, businesses can significantly reduce their overall tax burden.

Microcaptive

Furthermore, understanding the various tax credits available can be another valuable tool in minimizing your tax liability. Unlike deductions that subtract from taxable income, tax credits directly reduce the amount of tax owed. This means that if you have a tax liability of $10,000 and are eligible for a $2,000 tax credit, your final tax bill would be reduced to $8,000. Tax credits can be linked to a variety of activities, such as hiring certain types of employees, investing in renewable energy sources, or conducting research and development initiatives. By identifying and utilizing these credits, businesses can maximize their tax savings.

Navigating the world of tax deductions and credits requires careful attention to detail and thorough knowledge of the applicable laws and regulations. Consulting with a tax professional or accountant specializing in business taxation can be immensely beneficial in ensuring that you take full advantage of available deductions and credits while remaining compliant with the law.

By comprehending the complexities of tax deductions and credits, businesses can unlock secrets to minimizing their tax burden effectively. Consider taking advantage of these opportunities and make sure to explore the further sections of this guide to gain a comprehensive understanding of Business Tax Law.

Complying with Tax Reporting and Filing Requirements

Keeping up with tax reporting and filing requirements is essential for businesses to stay compliant with business tax law. Here are a few key points to consider when navigating this process.

Firstly, it is crucial to understand the various tax forms and schedules that businesses may be required to file. These can include but are not limited to, the Form 1120 for corporations, Form 1065 for partnerships, and Form 1040 for sole proprietorships. Each form has its own specific requirements and deadlines, so it is important to familiarize yourself with the necessary documentation for your business structure.

Secondly, accurate record-keeping plays a significant role in meeting tax reporting and filing requirements. It is essential to maintain organized and up-to-date financial records, including income statements, balance sheets, and expense records. These records can help substantiate the information reported on tax forms and schedules and provide evidence of compliance in case of audits or inquiries.

Lastly, businesses must pay close attention to tax filing deadlines to avoid penalties and interest charges. The Internal Revenue Service (IRS) sets specific due dates for different tax forms, and failing to meet these deadlines can result in costly consequences. Therefore, it is advisable to establish a reliable system to track and meet these crucial deadlines, including the use of reminders or professional tax software.

By understanding the tax forms and schedules, keeping accurate records, and staying on top of filing deadlines, businesses can navigate the complexities of tax reporting and filing requirements with greater ease and ensure compliance with business tax law.